Details

Features

Live validation while typing

Validates all EU based VAT numbers at VIES (VAT Information Exchange System). Offline validates numbers for syntactically correctness.

User friendly and error reducing

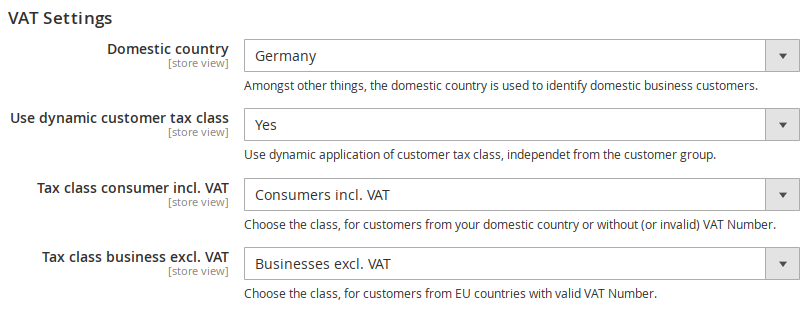

Dynamic customer tax class

You do not need to assign customers to special "without tax" groups anymore. The extension applies the tax class according to the common use cases we worked out with you (our customers) based on the customers address and validation data.

Allows you to manage cases not supported by Magento core.

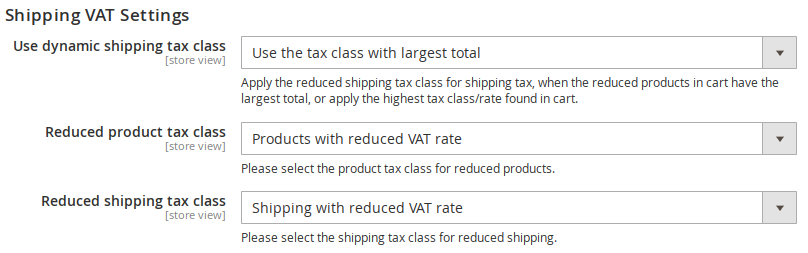

Dynamic shipping tax class

You can select the method for calculating the reduced VAT rate when your cart contains only reduced products, or when the total value of reduced products constitutes the majority of the cart's value.

Adds more options for calculating the shipping tax rate.

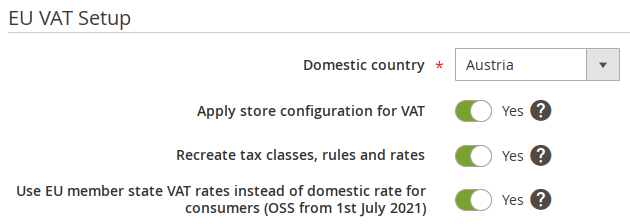

Automated setup

Quickly setup tax classes, tax rates and tax rules using the default tax rates and configure them in Magento.

Saves you a lot of clickwork when starting a new project.

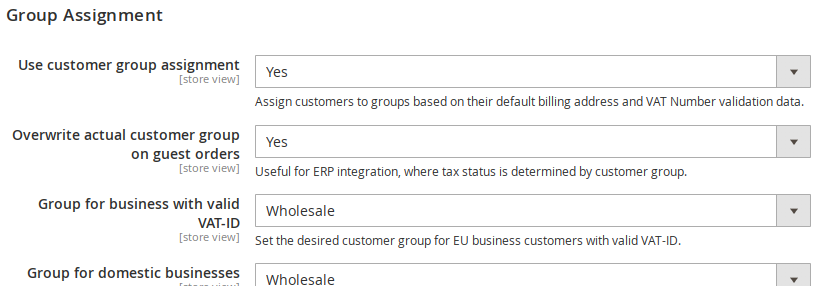

Customer Group Assignment

Automatic assignment to the following customer groups:

B2C General, B2B in Europe, B2B Domestic, B2B/B2C International, Invalid VAT-ID, Technical Errors

Using the group assignment is optional.

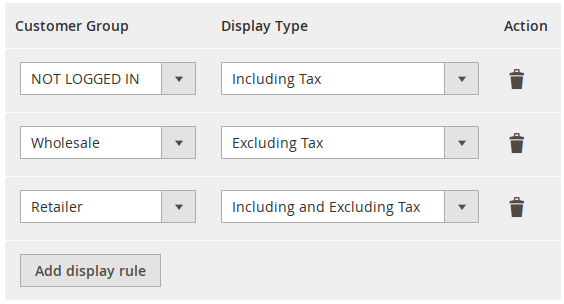

Price Display by Customer Group

You need to show prices incl. tax to B2C, but need to display them excl. tax or both for B2B?

With the flexible price display settings you have everything in control.

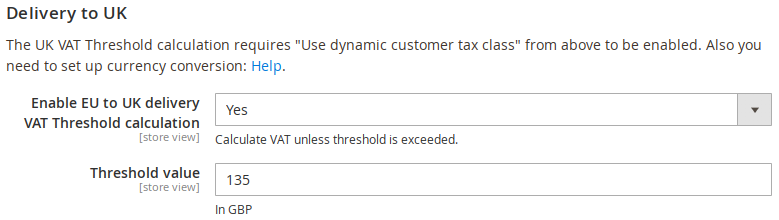

Brexit Support

When you ship to the UK you probably have to consider the threshold of 135 GBP.

Easily enable automated handling of the UK delivery threshold with currency conversion.

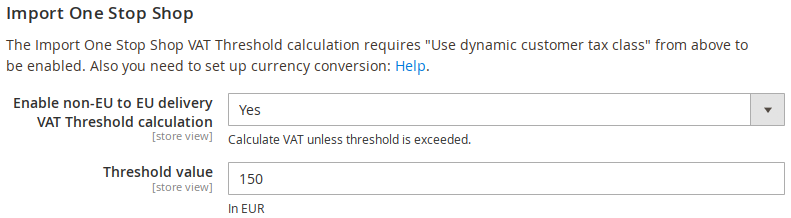

IOSS Support

Non-EU countries shipping to the EU are covered as well.

Easily enable automated handling of the EU delivery threshold with currency conversion.

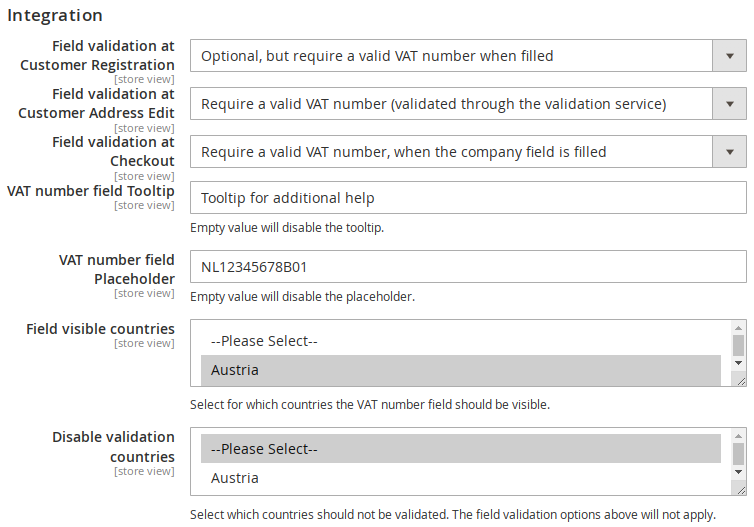

Many integration options

Primary for Luma based themes the extension leaves no wishes unfulfilled.

The extension is compatible with Hyvä Themes, supporting almost all integration options.

More Features

- Supports Treshold countries, when you need to calculate the VAT rate of the threshold country.

- VAT Numbers can be validated from the frontend for customers or from the Magento backend for administration users

- Extends the customer address management with more information about the VAT number validation, like the company name and address details (if supported by the member state)

Works with third party checkout modules:

- OneStepCheckout (The Original)

- Aheadworks OneStepCheckout

- Amasty Checkout

- BSS Commerce One Step Checkout

- Mageplaza OneStepCheckout

- Swissuplabs FireCheckout

Requirements

- PHP Version 7.1+, PHP Extension SOAP, PHP Extension cURL

Disclaimer

This extension uses the EU VIES (VAT Information Exchange System) service to validate the VAT-IDs of your customers. It is possible that this service experiences downtimes where it is not possible to validate the VAT Numbers of your customers. In such cases, it does not constitute a malfunction of our module and your customers will still be able to register or checkout in your shop. The specific disclaimer for the VIES does also apply on our module.

This page and our software does not constitute tax advice and is merely intended to serve technical solutions to common issues with business requirements in Magento. For tax information please consult your tax advisor.

Additional Information

| Delivery Time | Immediately after payment receipt |

|---|---|

| Magento Version | Magento 2 / Adobe Commerce |

| URL to Documentation | https://www.geissweb.de/docs/magento-2/eu-vat-enhanced.html |

| Compatible Magento Versions | Adobe Commerce 2.3, Adobe Commerce 2.4, Hyvä Checkout, Hyvä Themes, Mage-OS 2.4, Magento Open Source 2.3, Magento Open Source 2.4 |

| Neuste Versionsnummer | 1.25.6 |

| Besondere Hinweise | Compatibility with Magento versions smaller than 2.3.7 is available with older versions of the extension. |